Before making the leap to the cloud, it’s crucial for banks and insurers to understand what cloud services bring to the table.

Did you know?

The global cloud computing banking market is projected to reach $301 billion by 2032! That’s because cloud computing is revolutionizing the banking and insurance industry, making operations more agile, cost-effective, and secure.

As financial institutions navigate an increasingly digital world, cloud adoption has become more of a necessity than an option. From enhancing data security to enabling seamless digital banking experiences, the cloud is setting new standards in efficiency and innovation.

Benefits of Cloud Computing in Banking

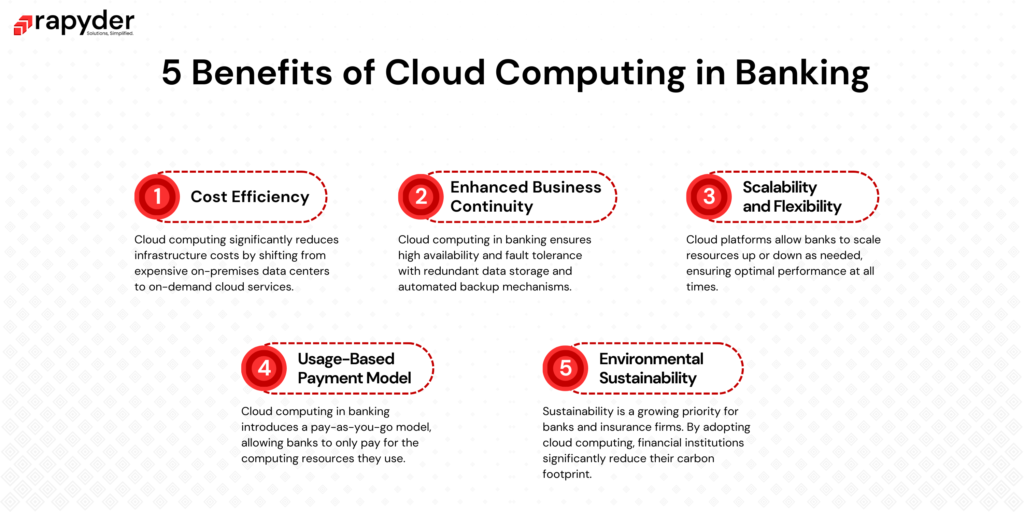

1. Cost Efficiency

Cloud computing significantly reduces infrastructure costs by shifting from expensive on-premises data centers to on-demand cloud services. Banks no longer need to invest heavily in physical hardware, and instead, they can rely on cloud providers to manage the infrastructure.

Additionally, by optimizing resource usage, cloud computing in banking lowers energy consumption, ensuring that financial institutions only pay for the computing power they use. This shift minimizes idle resources, leading to more efficient operational spending and allowing banks to focus their budgets on innovation and customer service.

2. Enhanced Business Continuity

Financial institutions cannot afford downtime, as even a minor disruption can result in significant losses. Cloud computing in banking ensures high availability and fault tolerance with redundant data storage and automated backup mechanisms.

Disaster recovery solutions built into cloud platforms provide an additional safety net, ensuring seamless restoration of critical banking applications. This guarantees uninterrupted banking services, enhances customer trust, and safeguards institutions from data loss due to unforeseen incidents.

3. Scalability and Flexibility

The banking industry experiences fluctuating demands, during peak times, such as salary days or tax seasons, transaction volumes surge. Cloud platforms allow banks to scale resources up or down as needed, ensuring optimal performance at all times.

Furthermore, launching new banking services or applications becomes significantly faster with cloud infrastructure. This enables financial institutions to remain agile and respond to market needs without the delays associated with traditional IT provisioning.

4. Usage-Based Payment Model

Cloud computing in banking introduces a pay-as-you-go model, allowing banks to only pay for the computing resources they use. This eliminates the financial burden of maintaining underutilized infrastructure and provides greater control over IT expenses.

With predictable cost structures, banks can manage budgets effectively while ensuring access to cutting-edge cloud services that enhance operational efficiency.

5. Environmental Sustainability

Sustainability is a growing priority for banks and insurance firms. By adopting cloud computing, financial institutions significantly reduce their carbon footprint. Cloud providers operate energy-efficient data centers designed to optimize power usage and cooling, leading to lower overall energy consumption.

By eliminating the need for constant hardware upgrades and reducing electronic waste, banks contribute to greener IT practices and align with global sustainability initiatives.

Challenges in Adopting Cloud Computing

Despite its numerous advantages, transitioning to the cloud presents certain challenges for financial institutions.

1. Data Security and Privacy Concerns

Given the sensitive nature of financial data, banks must ensure that cloud solutions comply with industry regulations. Data breaches, cyber threats, and unauthorized access pose significant risks, requiring banks to implement robust encryption, multi-factor authentication, and continuous monitoring to safeguard customer information.

2. Integration with Legacy Systems

Many financial institutions still operate on legacy systems that were not originally designed for cloud environments. Migrating these systems to the cloud without disrupting banking operations is a complex challenge. Seamless integration between old and new infrastructures requires careful planning, custom solutions, and sometimes, a hybrid approach to ensure smooth functionality.

3. Regulatory Compliance

The financial sector is heavily regulated, with compliance requirements varying by region. Banks adopting cloud services must navigate complex regulatory frameworks, ensuring that their cloud environments are auditable and meet local and international legal standards. Achieving full transparency in cloud operations while maintaining data sovereignty adds another layer of complexity to cloud adoption.

Choosing the Right Cloud Service Model for Banks

Banks have multiple cloud service models to choose from, each offering unique benefits and challenges.

- Public Cloud

A public cloud is a shared computing environment where multiple organizations use the same cloud infrastructure provided by a third-party vendor.

This model is highly cost-effective, scalable, and easy to deploy, making it ideal for banks looking to digitize customer interactions quickly.

- Private Cloud

A private cloud is dedicated solely to a single organization, providing enhanced security, greater control over data, and customization options.

This model is particularly beneficial for banks handling sensitive transactions and regulatory compliance.

- Hybrid Cloud

A hybrid cloud model combines the best of both public and private clouds, allowing banks to keep critical operations on a private cloud while leveraging the scalability of the public cloud for customer-facing services. This model offers flexibility and optimized cost management.

Rapyder: The Trusted Cloud Partner for BFSI Transformation

Financial institutions require a reliable cloud partner to ensure a smooth, secure, and compliant transition to the cloud. Rapyder has emerged as a leading cloud solutions provider for the banking and insurance sector, offering tailored services that address industry-specific challenges.

Rapyder’s expertise spans cloud migration, security enhancement, cost optimization, and AI-driven banking solutions. By collaborating with leading cloud providers like AWS and Azure, Rapyder helps financial institutions build a resilient, scalable, and efficient cloud infrastructure that drives innovation.

Case Studies: Successful Cloud Adoption in Banking

- RupeeRedee – AWS Cloud Migration

RupeeRedee, a prominent fintech company, faced challenges in scaling its infrastructure to meet increasing customer demands. They partnered with Rapyder to migrate their operations to AWS Cloud.

They achieved a fivefold increase in capacity, enhanced user experience, and realized a 30% reduction in operational costs. This transformation not only improved performance but also positioned RupeeRedee for future growth.

- Gen AI Chatbot – Enhancing Customer Experience

Fibe, a company dedicated to serving young professionals, sought to enhance its user engagement. Collaborating with Rapyder, we developed a Gen AI-powered chatbot that delivers rapid responses within 2-3 seconds, significantly reducing user wait times.

This chatbot now manages over 400,000 conversations, serving a user base exceeding 5 million, with an average of 10 messages per conversation.

Conclusion

Cloud computing is redefining the banking sector, making it more efficient, secure, and scalable. As financial institutions embrace this transformation, they must carefully evaluate their cloud strategies to ensure compliance, security, and seamless integration.

The future belongs to banks that leverage cloud-powered innovation!

Ready to take the leap? Get in touch with us now!

Our Services

Cloud Migration Services | AWS Migration Services | Cloud Managed Services | AWS Managed Services | AI ML Services | Generative AI Services | App Modernization Services | AWS App Modernization Services | VDI Solutions | AWS Pinpoint | AWS Graviton | Database Modernization Services